What We do

BASIX Employees and Agents Mutually Aided Cooperative Society Limited (BEAMACS) was registered as Mutually Aided Cooperative Society under Section 5 of Andhra Pradesh Mutually Aided Cooperative Societies Act, 1995 with a motive of encouraging all employees and agents of BASIX Social Enterprise Group (BASIX SEG) to become its members and avail its services in cooperative mode.

Since then the Society began to grow with steady pace on increasing the number of members, regular savings and distribution of loan products for the welfare of the members of the Society.

The operational performance of your society are as follows:

| Particulars | April 01, 2019 – March 31, 2020 | Cumulative Till March 31, 2020 |

|---|---|---|

| No of Entities Covered | 11 | 15 |

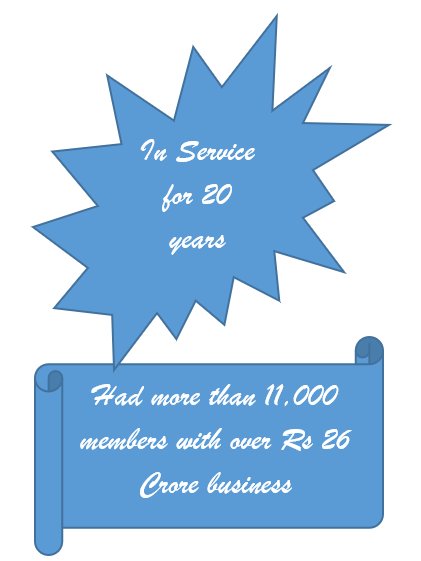

| No of Members Enrolled | 883 | 11,171 |

| No of Active Members | 1,776 | 1,776 |

| Share Capital Collected | ₹ 0.8 | ₹ 11.2 |

| Loan Disbursed | ₹ 268.5 | ₹ 1,724.3 |

| Loans Outstanding | ₹ 196.4 | ₹ 196.4 |

| Savings Collected | ₹ 118.2 | ₹ 888.6 |

| Savings Outstanding | ₹ 275.2 | ₹ 275.2 |

| Interest Income | 27.5 | ₹ 253.8 |

| Interest Expense | ₹ 20.4 | ₹ 162.6 |

| Net Surplus | ₹ -6.0 | ₹ 60.1 |

| Share Capital | ₹ 1.8 | – |

| Reserves & Surplus | ₹ 89.1 | – |

| Recovery Rate | 99.99% | 99.99% |

It was proud to record that, BEAMACS so far did not reach out for any external financial support to meet its member’s loans requirements. All the loans provided so far, are out of the savings and interest collected from its own members.

On behalf of the Society, we continue our endeavor to have more member enrolment in the Society from BASIX Social Enterprise Group.

What We Do

Encouraging Savings

-

- Encourage all the employees and others associated in the BASIX SEG to join in the society at the time of joining in BASIX.

- To cultivate the habit of regular savings.

- Members savings are deducted on monthly basis from the salary by respective entity they are employed.

- Has the option to withdraw savings over and above threshold limit.

Access to Credit

- A member is eligible to access to credit after contributing savings for six months.

- Credit limits are on the basis of savings made and age of the members in the society

- Customized the credit products to meet the needs of the members

- Interest on credit is on diminishing balance

Competitive return on savings

- Returns on savings is at par with schedule / private banks

- Return on savings is paid on half yearly basis

Hassle free loans with low interest rates

- Simplified loan documentation for each of the loan product

- Application can be made through mobile app or physical form

- A member can opt for maximum of three loan products on the basis of savings and age in the society

- Loans discussed to the bank account of the members

- Flexible repayment schedule

- Has option to pre-close the loan/s at nil cost

- Loan repayments collected from monthly salary deductions

Other significant activities

- Member welfare activities covers social, cultural events

- Annual General Body meetings are conducted to fill the vacancies of directors

Our mission

To promote the economic and social betterment of its members through thrift, credit self-help, and mutual aid in accordance with the principles of co-operation

Our Vision

Economic and social empowerment of its members in accordance with the principles of co-operation and mutual aid.